Gold Barrick: An alternative way to invest in gold.

- Glenn

- Oct 23, 2022

- 11 min read

Updated: Aug 7, 2023

In the current economic environment, it may be a good idea to diversify one's portfolio into assets such as gold. In the 8 months recession in 2001 gold rose by 5,0 % while the S&P 500 dropped -1,8 %, while gold returned 16,3 % in the 18 months recession starting in 2007 compared to -37,4 & of the S&P 500. However, it doesn't mean that gold will outperform equities in recessions to come. An alternative way to get exposure to gold is through Barrick Gold that currently pays a 5 % dividend.

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

Since I have attended the workshop with Phil Town, I have decided to change the layout of my analyses a bit. I will do some more calculations and also briefly go through why the company has meaning to me. If you want to read more about how I evaluate a company, please go to "MY STRATEGY" on my website.

This analysis will be a bit different than my usual analyses. It is because I believe that you cannot analyze a mining company as you can with other companies due to commodity prices being what drives the price of miners. Hence, mining companies come with more risks than other companies. I will go through some of them later in this analysis. I should also mention that I'm in no way an expert in commodities, meaning it is important that you do your own research before investing in a company such as Gold Barrick. I will try to keep the format in this analysis the same as in my other analyses, even though the historical numbers are not as important as when analyzing companies in other sectors. I should also mention that the reason I have precious metals in my portfolio is due to the macro-economic environment we are in for the time being. I do not necessarily want to keep it long term. For full disclosure, I should mention that I do currently own shares in Gold Barrick, as it 3, 59 % of my portfolio. If you want to see my portfolio or if you want to copy it, you can see how to do so here.

Barrick Gold is one of the world largest gold mining companies with operations in 18 countries in North- and South America, the Caribbean, The Middle East, Africa, and Oceania. Gold Barrick entered the gold business in 1983 and has its headquarters in Toronto, Canada. Gold Barrick mainly mine gold (89,6 % of revenue) but also mine copper (8,0 % of revenue) and has segment called other (2,4 % of revenue). What differentiate Gold Barrick from other companies I usually invest in is that they I don't believe they have a moat, even though you could argue that there are high barriers of entry in the sector they operate in. It means that you obviously need to be aware of the risks that I will come back to later. However, I do feel comfortable for the time being to invest in Gold Barrick, as they are one of the largest gold miner companies in the world, which means they have a lot of experience in gold mining.

Their CEO is Mark Bristow. He became the CEO in 2019 when Barrick Gold merged with Randgold Resources. Prior to the merger between the two companies, he was CEO in Randgold Resources. He holds a PhD in geology from the University of Natal in South Africa. Prior to joining Gold Barrick, he is credited to have built Randgold Resources from being a small Africa focused exploration business into the one of the industry's most profitable and best managed gold miners. He is known for his pivotal role in promoting the emergence of a sustainable mining industry in Africa, and sustainability is something he continues to focus on at Gold Barrick. Furthermore, he has a proven track record of delivering shareholder value. Personally, I like how he has focused on paying off debt since he took the role as CEO in Barrick Gold. According to Comparably, Mark Bristow has an employee rating of 70, which isn't extraordinarily good but isn't bad per se. His employee rating is a bit better at Glassdor, where he got a very solid 92 % approval rating. Personally, I'm very confident in Mark Bristow as he has the education, experience, and track record to grow Barrick Gold moving forward.

I really do like the management of Gold Barrick, and even though they have no moat, and the historical numbers are not that important, I would still like to shortly run through the numbers. In case you want an explanation about what the numbers are, you can have a look at "MY STRATEGY" on the website.

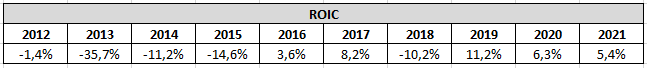

The first number we will look into is the return on investment capital, also known as ROIC. Normally, we want to see 10 years of history and we want the numbers to be above 10 % in all the benchmarks. Overall, the numbers are underwhelming. Gold Barrick only manages to reach the required 10 % or more once in the last 10 years. The older numbers are disastrous but since 2016, Gold Barrick has managed to deliver a positive ROIC every year except for 2018, which is natural as it is where the merger with Randgold Resources happened. It worth noting that Gold Barrick has delivered a positive ROIC in every year that Mark Bristow has been the CEO.

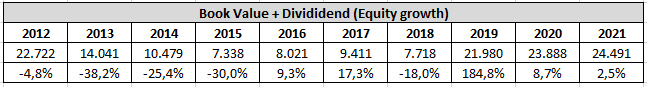

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. The equity growth is a bit of a mixed bag as it follows the same pattern as we saw in the ROIC. Disastrous numbers until 2015 and acceptable numbers from 2016 and onwards, except for 2018 where the merger happened

Finally, we investigate the free cash flow. In short, free cash flow is the cash a company generates after it has paid for operating expenses and capital expenditures. Levered free cash flow is the amount of money a company has left remaining after paying all of its financial obligations, I use the margin for it to make more sense. Free cash flow yield is the free cash flow per share a company is expected to earn against its market value per share. One thing that is worth noticing is that Gold Barrick has delivered a positive free cash flow since 2015, which is always nice to see. It is not a surprise to see that Gold Barrick delivered their highest free cash flow in 2020, which shows that Gold Barrick's operations are strongly correlated with the price of gold. If gold prices are going to spike, Gold Barrick will deliver higher free cash flow. It is also why we see a higher leveraged free cash flow margin in the last three years, while the higher free cash flow yield indicates that company is cheaper than usually, but we will get back to that later in the analysis.

Another important thing to investigate is debt, and we want to see if a business has a reasonable debt that can be paid off within 3 years. We do so by dividing the total long-term debt by earnings. When you are making these calculations on Gold Barrick, you see that they have a debt that can be paid off in 2,67 years. It is acceptable and it is reassuring that Mark Bristow is very committed to pay off debt.

Based on my findings so far, Gold Barrick could be an interesting company to add to the portfolio. However, there are some risks that you would need to be aware of. Gold Barrick lists 47 different risk factors in their annual report! I will not go through all 47 risk factors, but it is something you should read through if you are going to invest in Barrick Gold. Instead, I will shortly mention what I believe are some of the largest risk factors when investing in any mining company. Especially because they are risks that mining companies cannot really do anything about. Hence, it should be something you monitor yourself. The first and most obvious one is the price of commodities. If prices of the commodities a company mine drops, it will affect the revenue of the company. Barrick Gold is operating with a cost of sales of gold per ounce of $1.150, so they still have plenty of room for the price of gold to drop, but it is certainly something you will need to monitor. The other major risk is that the estimates that mining companies make for each mine are uncertain. The mine could have less (or more) of the commodity than expected, which could hurt (or improve) the revenues. This is where experience and good management comes in. Finally, we have the short-term risk of macroeconomics. Like other companies, Barrick Gold face some macroeconomic risks such as labor costs, material and consumables costs, and fuel and energy costs. These costs as still on the rise and will affect the profitability of the company, and it could go on for much longer.

There are also plenty of reasons to invest in Barrick Gold. One is as a hedge to recession. I already mentioned that during the last two longer recession, the price of gold outperformed the stock market. Investors tend to flee into safer investments once the stock market tumbles. I already gave some examples in the intro of this analysis; another example is that the price of gold more than doubled from 2007 to 2011 during the last crash. Another reason for me to invest in Gold Barrick is that they work on a cost of sales of $1.150 an ounce and run their business based on that price, and as I write this the price of an ounce of gold is $1.657. You might want to ask yourself what they are going to do with that extra cash? The answer is that the board has approved a higher dividend based on their net cash. Gold Barrick has a quarterly base dividend of $0,10 per share. However, they also have a quarterly performance dividend that depends on their net cash level. If net cash is below $0, they pay no performance dividend, while it is $0,05 per share when the net cash is between $0 and $0,5 billion, if the net cash is between $0,5 and $1 billion, they pay a performance dividend of $0,10 per share, while the performance dividend is $0,15 per share when the net cash is above $1 billion. Copper. Gold Barrick has exposure to copper as well, which could result in further growth. The demand of copper is expected to grow as we see global trends towards decarbonization and renewable energy, and management believes that it will result in a long-term fundamental strength in copper. Currently, Gold Barrick has a cost of sales per pound of copper of $2,50, which is under the current price of copper.

All right, we have gone through the numbers, potential and risks regarding Gold Barrick, and now it is time for us to calculate a price for Gold Barrick. To calculate price, we will need the numbers that I have explained in the "MY STRATEGY" section of the website, as I do not want to go through the whole calculation here. I decided to use an EPS at $1,14, which is the one from 2021. I chose an Estimated future EPS growth rate of 5,50 (I believe that this is a bit conservative growth rate as Finbox expects a growth rate of 6,1). The Estimated future PE is 11 (which the double of the growth rate, as the historically PE for Gold Barrick has been higher) and we already have the minimum acceptable return rate on 15 %. Doing the calculations by using the formula I described in "MY STRATEGY" we come up with the sticker price (some call it fair value or intrinsic value) of $5,29 and we want to have a margin of safety on 50 %, so we will divide it by 2, meaning that we want to buy Gold Barrick at price of $2,65 (or lower obviously), if we use the Margin of Safety price.

Our second way to calculate a buy price is the TEN CAP price, which is also explained at "MY STRATEGY". To do so, we need some numbers from their financial statements, keep in mind that all numbers are in millions. The Operating Cash Flow last year was 4.378. The Capital Expenditures was 2.435. I tried to look through their annual report to see, how much of the capital expenditures were used on maintenance. I couldn't find it though, so as a rule of thumb, you expect 70 % of the capital expenditures to be used on maintenance, meaning we will use 1.704,5 in our further calculations. The Tax Provision was 1.344. We have 1.779 outstanding shares. Hence, the calculation will be like this: (4.378 - 1.704,5 + 1.344) / 1.779 x 10 = $22,58 in TEN CAP price.

The last calculation is the PAYBACK TIME. I also described in "MY STRATEGY". With the Free Cash Flow Per Share at $1,09 and a growth rate of 5,5 %, if you want your purchase back in 8 years, the PAYBACK TIME price is $11,22.

I believe that Barrick Gold is a good mining company with a great management. There are a lot of uncertainty in the current economic environment, and it may be a good idea to have some exposure to precious metals. However, there are some risks when it comes to Gold Barrick as costs are expected to increase and because the stock price is highly correlated to the price of gold. Hence, there are things that needs to be monitored if you invest in the company. You could choose to buy gold instead, but I believe that Gold Barrick is a great alternative because it is so correlated to the price of gold and they pay a 5 % dividend while waiting (the dividend yield may be lower next year, as explained previously) for the price of gold to rise. Personally, I don't want too large of my portfolio to be in precious metals, but I do feel comfortable in buying Barrick Gold between the TEN CAP price of $22,58 and the PAYBACK TIME price of 11,22. Meaning that if I didn't have such a great exposure to gold already, I would buy Barrick Gold below $16,9.

I also write exclusive posts on Medium. If you want to read my posts, you can join Medium by clicking here. It costs $5 a month, but it will allow you to access all my posts as well as everything else on Medium, which is highly recommendable.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how to do it, you can read this post.

I hope that you enjoyed my analysis. Unfortunately, I cannot do a post of all the companies I analyze. I am available to copy but if you do your own trades, you can follow me on Twitter instead, as I tweet when I buy or sell anything.

Some of the greatest investors in the world believe in karma, and in order to receive, you will have to give (Warren Buffett and Mohnish Pabrai are great examples). If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to the African painted dog. It is something I have donated to myself. If you have enjoyed the analysis and want some good karma, I hope that you will donate a little to these fantastic animals through here. Even a little will make a huge difference to save these wonderful animals. Thank you.

Comments