Lululemon: The best company in its sector.

- Glenn

- Oct 1, 2022

- 12 min read

Updated: Jan 26

Once you start investing, you are always on the lookout for the top-performing companies in various sectors. When it comes to the athletic clothing industry, I believe Lululemon stands out as the best company. It certainly is if you compare their margins with those of some of their competitors. In their last financial year, Lululemon achieved a gross profit margin of 58,3 % and an operating margin of 22,9%, surpassing the margins delivered by companies such as Nike, Adidas, Under Armour, and Puma. Is now the time to buy Lululemon?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that at the time of writing this analysis, I do not own shares in Lululemon or any companies that are direct competitors. However, I do own shares in Crocs. If you are interested in copying my portfolio or viewing the stocks I currently own, you can find instructions on how to do so here. I first came across Lululemon during my investment workshop with Phil Town, where Lululemon was identified as one of the 10 great companies to keep an eye on. It has been on my watch list, but I have not yet taken a position. If you want to purchase shares or fractional shares in Lululemon, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

Lululemon was founded in 1998 in Vancouver, Canada. The company specializes in designing, distributing, and retailing athletic apparel and accessories. Their products are designed for various athletic activities, but the company is particularly focused on yoga. In 2020, they diversified their portfolio by acquiring MIRROR, an in-home fitness company. MIRROR offers an interactive workout platform that includes live and on-demand classes. Their largest customer group is women, representing 64% of their revenue in fiscal 2024, while their largest geographical market is the Americas, representing 79% of their revenue in fiscal 2024. Lululemon operates 711 stores worldwide, with 367 located in the United States. China is the country with the second-highest number of stores, with 127 stores located there. Management believes that the Lululemon brand has some unique strengths, such as the consistent innovation in performance, being a dual-gender brand with appeal across various occasions, and its ageless quality that attracts shoppers of all generations, including moms, daughters, and grandmas. Management believes that it is something none of their competitors can compare to, and it is what gives Lululemon its moat. I agree with management. Another indication of the brand's strength is that Lululemon expands its customer base without resorting to price promotions or discounts, and the company has no plans to shift away from its full-price business model. Furthermore, Lululemon could increase its prices in response to the current inflation without facing price resistance. I believe that Lululemon has a strong brand moat.

Management

The CEO is Calvin McDonald. He first joined Lululemon in 2018 and has been the CEO ever since. Prior to joining Lululemon, Calvin McDonald was the President and CEO of Sephora Americas. He also has experience in the retail sector in Canada. He has an MBA from the University of Toronto and a Bachelor of Science degree from the University of Western Ontario. Besides being the CEO, he also serves on the Board of Directors of Lululemon and the Walt Disney Company. Calvin McDonald has done a remarkable job at Lululemon, delivering double-digit revenue growth annually under his leadership. He is recognized as a growth-oriented leader with a proven track record of assisting large organizations in scaling, innovating, and enhancing customer engagement in both physical stores and digital channels. According to Comparably, Calvin McDonald has an employee rating that places him in the top 5% of similar-sized companies. This is not surprising, as he mentioned in an interview that honesty and transparency are qualities he aspires to lead by. All in all, I feel very comfortable with Calvin McDonald as the CEO of Lululemon because he has delivered remarkable results and has a high employee rating.

The Numbers

The first number we will investigate is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Lululemon has delivered a Return on Invested Capital (ROIC) above 15% every year in the past ten years, above 20% in nine out of the past ten years, and above 30% in four of the past six years, which are truly impressive numbers. It is also encouraging to see that Lululemon has achieved its highest Return on Invested Capital (ROIC) in the past year. Only a few companies manage to deliver a consistently high Return on Invested Capital (ROIC) like Lululemon does. Thus, I find these numbers very intriguing.

The following numbers represent the sum of the book value + dividend. In my previous format, this was referred to as the equity growth rate. It was the most important of the four growth rates I used in my analyses, which is why I will continue to use it in the future. As you are accustomed to seeing numbers in percentage form, I have decided to provide both the actual numbers and the year-over-year percentage growth. There have been some years in which the book value has decreased slightly, but it is nothing to worry about. Equity ticked up slightly in 2020 with the acquisition of MIRROR. It is reassuring to note that Lululemon has been steadily increasing its equity since then and achieved one of its highest year-over-year percentage growth rates in fiscal 2024.

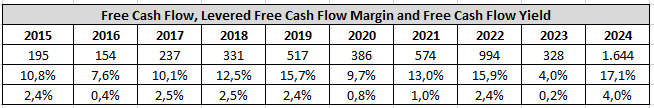

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. The first thing that comes to mind is that Lululemon has consistently generated positive free cash flow for the past ten years, which is always encouraging to observe. The decrease in 2020 is attributed to the acquisition of MIRROR. It is encouraging to see that Lululemon grew its free cash flow in 2021 and 2022. The challenging fiscal year of 2023 has had a negative impact on free cash flow, with Lululemon delivering its lowest free cash flow since fiscal 2018. However, Lululemon rebounded in fiscal 2024, delivering its highest free cash flow ever, which is very encouraging. Another encouraging sign is that Lululemon also achieved its highest levered free cash flow margin in 2024, following its lowest levered free cash flow margin in fiscal 2023. The free cash flow yield is at its highest level in the past ten years. It indicates that Lululemon is trading at its best valuation in the past ten years, but we will revisit this later in the analysis.

Debt

Another important aspect to consider is the level of debt. It is crucial to determine whether a business has manageable debt that can be repaid within a period of 3 years. We calculate this by dividing the total long-term debt by earnings. However, it isn't possible to make calculations on Lululemon because the company has no debt. In fact, Lululemon has not had any debt in the past 20 years, which is something I personally appreciate.

Exclusive Discounts on Seeking Alpha – Elevate Your Investing Today!

For those serious about investing, here's your chance to upgrade your strategy with exclusive offers you won't find anywhere else. These special discounts are available only through the links below—don’t miss out!

Seeking Alpha Premium: Access comprehensive financial data, earnings transcripts, in-depth analysis, market news, and more. Perfect for investors who want an edge in making informed decisions.

Special Price: $269/year (originally $299) + 7-day free trial.

Alpha Picks: Get stock recommendations from a portfolio that gained +177% compared to the S&P 500's +56% from July 2022 through the end of 2024.

Special Price: $449/year (originally $499).

Alpha Picks + Premium Bundle: The ultimate investment package with a $159 discount!

Special Price: $639/year (originally $798).

I use Seeking Alpha daily for its reliable insights and actionable strategies. These deals are available exclusively through my links, so take advantage of them now to level up your investment journey!

Act quickly - these prices won't last forever!

Risks

Based on my preliminary findings, I find Lululemon to be an intriguing company. However, no investments are without risk, and Lululemon also has some risks. One risk is competition. Lululemon operates in a highly competitive market. Competition may lead to pricing pressures, reduced profit margins, or lost market share, as well as a failure to grow or maintain its market share, any of which could significantly harm Lululemon's business and financial results. Many of Lululemon's competitors are large apparel and sporting goods companies with strong worldwide brand recognition, such as Nike and Adidas. Thus, many of Lululemon's competitors have significant competitive advantages. They possess longer operating histories, larger and broader customer bases, more established relationships with a wider range of suppliers, greater brand recognition, and more substantial financial, research and development, store development, marketing, distribution, and other resources compared to Lululemon. Furthermore, Lululemon has limited patents and exclusive intellectual property rights in the technology, fabrics, or processes underlying its products. This allows competitors to manufacture and sell products with performance characteristics, fabrication techniques, and styling similar to those of Lululemon's products.

A small percentage of suppliers and manufacturers produce most of their products. Lululemon doesn't manufacture any of their products themselves, which means they are heavily dependent on their suppliers. Many of the specialty fabrics used in its products are technically advanced textile products developed and manufactured by third parties and may be available from only one or a limited number of sources. Approximately 55% of Lululemon's products were manufactured by its top five vendors, with the largest vendor producing around 17% of its products. Moreover, about 52% of Lululemon's fabrics were supplied by its top five fabric suppliers, with the largest supplier contributing approximately 19% of the fabric used. Lululemon does not have any long-term contracts with its suppliers or manufacturers for production. Hence, if Lululemon were to lose some of their largest suppliers, it would have a negative impact on the business.

Acquisitions like MIRROR. While I do feel confident in management, I would prefer them to refrain from making acquisitions that do not align with the core business of Lululemon. Lululemon acquired MIRROR for $500 million in 2020. However, in fiscal 2022, the company had to take a $442,7 million impairment charge related to the acquisition. Management has mentioned that sales of the MIRROR hardware have been disappointing. As a result, they have decided to incorporate MIRROR into their paid loyalty program, Lululemon Studio. This means that customers will no longer be required to purchase the hardware. Hopefully, we won't see any more of these acquisitions outside of Lululemon's core business in the future.

Reasons to invest

There are also plenty of reasons to invest in Lululemon. One particularly interesting aspect is their ambitious five-year growth plan called "Power of Three x2." In the next five years, Lululemon aims to double its business and achieve a revenue of $12,5 billion. The management has a clear plan in place to accomplish this goal. They want to double the revenue from men's sales, double the revenue from digital sales, and quadruple their international sales. Lululemon is off to a good start with the Power of Three x2 growth plan. Since it was introduced two years ago, Lululemon has grown revenue at a 24% compound annual growth rate (CAGR), fueled by a 44% CAGR in its international regions. The company has also expanded its adjusted operating margin by 120 basis points, growing adjusted earnings per share (EPS) at a 28% CAGR, and continued to gain market share. And it is also worth noting that the management has successfully executed growth plans in the past. Their previous plan was called the Power of Three, in which they successfully doubled men's sales, doubled digital sales, and quadrupled international sales in approximately three years.

Low brand awareness. Management has mentioned that Lululemon's brand awareness remains low across most markets, which presents a significant opportunity for Lululemon to attract new customers. Thus, management has a strategy to build brand awareness. Over the past year, through their strategic investments in brand campaigns and community activations, they have successfully increased Lululemon's brand awareness in key markets. Brand awareness in the U.S. increased from 25% to 31%, while in China it rose from 9% to 14%. Management will continue these strategies in 2024 and will persist in strategically investing across all markets. They believe that the current growth, coupled with low brand awareness, indicates significant market share potential as brand awareness around Lululemon continues to increase.

Opening new stores. Management believes that Lululemon's stores facilitate a direct connection with their guests, which helps attract new customers to the brand. Therefore, management views stores as a means to expand the business and further increase market share. Lululemon opened 56 new stores in fiscal 2024, expanding its square footage by 15%. Management has robust plans in place to further strengthen Lululemon's position in the market. They will continue to open and optimize stores, with plans for five to 10 new store openings and 15 to 20 optimizations in the United States. Additionally, there are plans for 25 to 30 net new company-operated stores and 20 optimizations internationally, primarily in mainland China, in fiscal 2025. These new stores will contribute to an overall square footage growth in the low double digits in fiscal 2025. Therefore, it should increase sales and attract new customers to the brand.

Unlock Your Trading Potential with VIP Indicators

Transform your trading with VIP Trading Indicators - powerful, AI-driven tools designed to make you a more confident and profitable trader. Whether you're a beginner or an experienced investor, these indicators help you identify when to buy, sell, or take profit with up to 93% accuracy.

Here’s what makes VIP Indicators stand out:

Easy Setup in Just 1 Minute: Start trading profitably right away, even if you have zero experience.

Works on Any Market: Use VIP Indicators on stocks, forex, crypto, and more.

24/7 Support & Free Trading Course: Get live help and step-by-step guidance to maximize your results.

For just $9, you’ll gain instant access to all the tools, plus a 30-day risk-free guarantee. If it’s not the right fit, simply request a refund—no questions asked.

Take control of your trading journey today and see what VIP Indicators can do for you. Click here to start now!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 12,20, which is from the year 2023. I have selected a projected future EPS growth rate of 15%. Finbox expects EPS to grow by 16% in the next five years, but 15% is the highest number I use. Additionally, I have selected a projected future P/E ratio of 30, which is twice the growth rate. This decision is based on Lululemon's historically higher price-to-earnings (P/E) ratio. Finally, our minimum acceptable rate of return has already been established at 15%. After performing the calculations, we determined the sticker price (also known as fair value or intrinsic value) to be $366,00. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Lululemon at a price of $183,00 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company essentially represents its return on investment. The minimum annual return should be at least 10%, which I calculate as follows: The operating cash flow last year was 2.296, and capital expenditures were 652. I attempted to analyze their annual report in order to calculate the percentage of capital expenditures allocated to maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 456,4 in our calculations. The tax provision was 626. We have 126,222 outstanding shares. Hence, the calculation will be as follows: (2.296 – 456,4 + 626) / 126,222 x 10 = $195,34 in Ten Cap price.

The final calculation is referred to as the Payback Time price. It is a calculation based on the free cash flow per share. With Lululemon's free cash flow per share at $13,03 and a growth rate of 15%, if you want to recoup your investment in 8 years, the Payback Time price is $205,69.

Conclusion

I believe that Lululemon is an intriguing company. They have been growing rapidly and have developed a strong brand moat. Outside of the MIRROR acquisition, the CEO has done a remarkable job, and I feel confident in the management. Lululemon has consistently delivered a high Return on Invested Capital (ROIC), and its free cash flow and levered free cash flow margin have just reached their highest levels ever. Lululemon operates in a competitive market where some of its competitors are significantly larger and have a longer history. Lululemon only holds limited patents and exclusive intellectual property rights. Therefore, competition is something that requires monitoring. Lululemon also relies on a limited number of suppliers and does not have any long-term contracts with them. Thus, it could hurt the business if some of these suppliers chose not to supply Lululemon. Hopefully, management has learned its lesson from the MIRROR acquisition, and Lululemon will refrain from making any acquisitions outside of its core business in the future. Lululemon is growing rapidly, and its management has high ambitions and a track record of successful delivery. Thus, Lululemon could continue to grow in the future, particularly since brand awareness of the Lululemon brand is still relatively low. As the brand becomes more recognized, Lululemon will attract more customers. Another way to attract customers is through store openings, and Lululemon continues to open stores every year. Management expects this trend to continue, which could serve as another growth catalyst. I really like Lululemon, and quality companies like Lululemon rarely trade at a 50% discount on intrinsic value. I believe that purchasing Lululemon below $292, which offers a 20% discount on the intrinsic value based on the lowest calculation, the Margin of Safety, could be a sound investment for long-term investors.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how I do it, you can read this post.

I hope that you enjoyed my analysis. Unfortunately, I cannot do a post of all the companies I analyze. I am available to copy but if you do your own trades, you can follow me on Twitter instead, as I tweet when I buy or sell anything.

Some of the greatest investors in the world believe in karma, and in order to receive, you will have to give (Warren Buffett and Mohnish Pabrai are great examples). If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to "Til The Cows Come Home". The organization is doing a great job for farm animals in Australia, and is one I donate to myself. If you have enjoyed the analysis and want some good karma, I hope that you will donate a little to Til The Cows Come Home here. Even a little will make a huge difference to save these wonderful animals. Thank you.

Comentarios